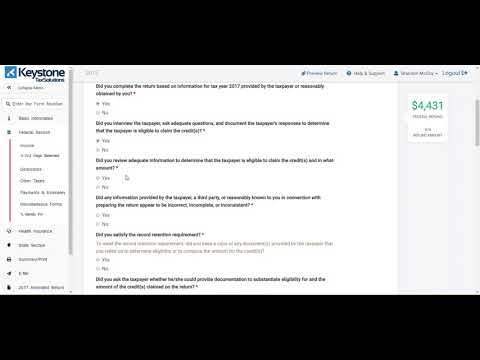

P>While everyone, this is Latoya with Keystone tech solutions. Today, this video is going to show you how to fill out your questions for your due diligence, which is your eddie 867 form. Once you've entered all your information for your federal side (including personal information, dependent information, and deductions), you will come to the next page. This page will notify you that your federal site is complete. Click on the summary to see a summarized return and a breakdown of the AGI. Now, click on continue. This is your due diligence checklist, basically your any x67 form. We will now go through these questions. The first question is, "Was the taxpayer or spousal non-resident alien for part of the year?" Usually, the answer to this question is no. The next question is, "Is the taxpayer a qualifying child or another person?" Click no. The third question is, "Did you complete the return based on information for tax year 2017 provided by the taxpayer or reasonably obtained by you?" Answer yes. Next, it will ask if you interviewed the taxpayer and viewed any documentation to determine their eligibility. Answer yes. It will then ask if you reviewed adequate information to determine if the taxpayer is eligible to claim credits. Answer yes. If any information looks incomplete, inconsistent, or incorrect, click no. Did you satisfy the record retention requirements and check the documentation that the client provided? Enter the relevant documentation (W-2, ID information, social security cards, etc.) Next, it asks if you asked the taxpayer if they could provide documentation to substantiate the eligibility for and the amount of credit claims on the return. Answer yes. Did you ask the taxpayer if any credits were disallowed or reduced in the prior year? Answer no if it was not the case, otherwise, answer yes. Is the child currently or intended...

Award-winning PDF software

How to fill out 8880 Form: What You Should Know

The following items are needed to complete Form 8880: Complete all required fields. Enter all amounts of retirement savings contributions you have contributed for the current tax year. Include Form 3800, if available. (See IRS instruction for Form 3800) Form 8880 and Related Information — tax Returns If any of the following items are not included in a Form 8880— You do not have retirement savings contributions to report on Form 3800 Enter any amount in box 5, except that Form 3882 or 1099-K, for other non-qualified retirement savings, may be used to figure the amount deducted. The amounts on the line for Form 3882 or 1099-K, may be excluded from tax due to the Social Security Act. To figure the amount to deduct from your other forms of income, enter these amounts into the tax tables for Form 3510, Form 3520, and Forms 1040. A tax deduction is allowed for a nonqualified retirement savings contribution not included in Form 3882 or 1099-K. If you have tax-exempt distributions that were not subject to the Social Security Act, enter the percentage on line 4 on line 1 of Schedule A. Enter the amount of those distributions on line 6 of Schedule A. You did not have retirement savings contributions to report on Form 3882 or 1099-K. Enter the amount of these contributions to line 6 on line 1 of Schedule A, Form 4797. You paid a cost of attendance deduction instead. Do not enter this amount on line 6. For more information, contact us. An amount in box 5, if any, from Form 3882 or 1099-K for non-qualified retirement savings contributions that may be deducted, can be carried over and included in your Form 1040, Schedule A, Schedule A-EZ. Do not report these amounts on Form 8880. It is important to note that a Form 8880-EZ or Form 8880-IEC may be available to you as an option for completing the Form 8880, instead of a printed form. Federal Form 8880 Instructions — Treasury Do not include any amounts paid on Forms 4797(b) or 4797(c), Social Security Administration Wage Statements. These are not required. If you are a spouse or a dependent, list all nonqualified retirement savings contributions to line 10 for Form 5498.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8880, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8880 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8880 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8880 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How To Fill Out Form 8880